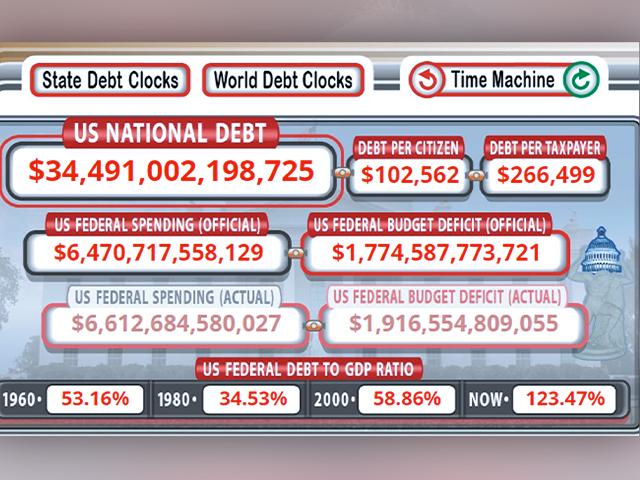

America's debt is rising by $1 trillion each 100 days, and economists warn it should solely worsen if Congress doesn't act.

The US nationwide debt, the cash our federal authorities borrows to cowl working prices, is now greater than $34 trillion. If that's not dangerous sufficient, the fast rise in rates of interest has pushed annual debt funds a lot increased and threatens to carry a possible future disaster.

“Proper now we're paying about $750 billion a 12 months in curiosity prices, which once more is roughly equal to what the USA spends on nationwide protection, should you can consider it,” stated Dr. Alexander Salter, affiliate professor of economics at Texas Tech College.

Dr. Salter says some forecasts predict curiosity funds alone will properly surpass the $1 trillion mark and will double by 2033. That's greater than America spends on the Division of Protection ($816.7 billion, in 2023), Homeland Safety ($30.3 billion, in 2023) and federal spending on kids ($761 billion), based on the Peter G. Peterson Basis , in 2022) and a number of other extra packages.

It additionally explains how the largest driver of the rising nationwide debt isn’t just outlandish authorities spending, however reasonably Social Safety, Medicare and Medicaid. Spending on these packages causes the federal authorities to pay an estimated $200 trillion in future liabilities.

“That's why we’ve to grasp that army help to Ukraine and Israel, we are able to focus on these points on their deserves, and we should always — but when we're speaking about 50 billion or 100 million, that's a drop within the bucket. by way of the long-term fiscal trajectory,” stated Dr. Salter. “We're not going to sort things by chopping issues, we’d like elementary structural reforms.”

Economists agree that the chance to America's credit standing and skill to lift funds makes the debt most likely one of many largest threats to our nationwide safety, because the US wouldn’t have the ability to afford the army sources it should want.

“In the event you can't place your bonds, should you can't management the sources; you’ll be able to't pay for tanks and fighter jets and bombs and all of the issues it’s good to preserve the nation protected,” stated Dr. Salter. .

Joel Griffith, an economics analysis fellow on the Heritage Basis, informed CBN Information that the worst is but to come back.

“We're paying for it now with these excessive inflation charges, and sorry to be the messenger of dangerous information, it's solely going to worsen within the coming a long time,” he stated. “Clearly we’ve a presidential election arising and it's essential that we’ve an sincere dialogue and debate about what these candidates would do to forestall us from going off the fiscal cliff.”