Nobody needs to get divorced. Not even these celeb unions that appear doomed from the beginning. They don’t need it. Nobody needs the ache and wreckage of divorce.

A bride and groom gaze down that aisle and envision a way forward for devoted teamwork fulfilling hopes and goals.

A bit of factor known as cash…

Nobody hopes to battle. Nobody goals about arguing. However what {couples} might not see as they gaze into their future is how a bit one thing that they’ve recognized since their childhood may simply come between them. A bit of factor known as cash.

Analysis reveals cash is the #1 cause {couples} cite when filling for divorce in America. And cash is usually blamed by folks divorcing who’ve loads of financial savings and money.

What are the explanations behind this typically ignored, however harmful pressure and what are you able to do about it? Begin by contemplating these 5 the reason why cash is the #1 explanation for divorce and the options:

Photograph Courtesy: Pina Messina/Unsplash

1. You earn cash choices each single day.

While you cope with one thing in your marriage again and again, it stands to cause that you’d have an elevated likelihood of experiencing battle over it. Most likely not lots of people battle with their partner about who will get to drive the yacht, however combating over each day use of cash stands to get a number of air time.

Convey two folks collectively and also you’re assured a distinction of opinion sooner or later. She thinks their funds would look higher if he took his lunch day-after-day as a substitute of consuming out at work. He thinks she may seize a cup of espresso at dwelling every morning versus spending $5 a day on the drive-thru. And so it begins.

Answer: Handle points as they come up. Don’t allow them to fester or construct. In case your partner doesn’t appear to suppose it’s a problem, nevertheless it bothers you – it’s value discussing.

Photograph Courtesy: Unsplash/Christin Hume

2. You could not understand it, however cash fights really feel very private.

You could suppose cash is only a “charge of change” or {dollars} and cents – one thing very tangible and unemotional, however that isn’t essentially the case.

When somebody criticizes your use of cash it feels very private. The accusation or assault feels prefer it’s about you, the core of you, not nearly lattes, bank card swipes, and receipts.

Photograph Courtesy: Pexels

The way in which you strategy cash is central to your character.

The way in which you strategy cash is a part of your DNA and central to your character so any blaming or attacking about your use of cash appears like you’re being criticized for who you’re, not simply the way you spend or save.

Answer: Cease and think about your variations. Recall that your variations have been a part of the preliminary attraction to at least one one other. Keep in mind the outdated “toothpaste rule”. Saying a hurtful phrase is like squeezing a tube of toothpaste, it’s messy and as soon as it’s out, you may’t put the mess again within the tube.

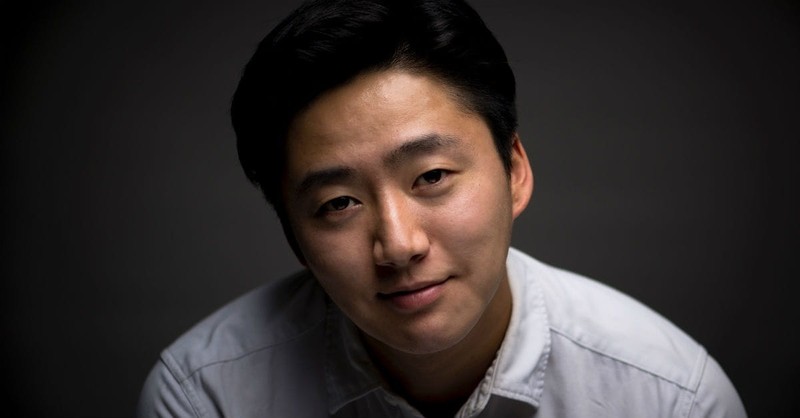

Photograph Courtesy: Kyu Lee/Unsplash

3. Roles are undefined or ill-defined.

One more reason {couples} expertise battle when coping with cash is their lack of comprehensible roles or poorly assumed or “assigned” roles in dealing with funds.

You married a helpmate, a teammate, a buddy, and a co-collaborator. Not your mother or your dad. The knowledge of the phrase tells us to “depart and cleave” so keep away from establishing a guardian/baby relationship once you and your partner deal with your cash.

Nobody ought to really feel like they’re receiving an allowance from their partner. And no partner ought to be left at midnight concerning the monetary realities of your family. An imbalance steers the connection into harmful waters. The “guardian” feels all of the strain and doubtlessly wields an excessive amount of energy and the “baby” feels belittled or unappreciated.

Photograph Courtesy: Unsplash/Ryan Jacobson

Meet to be sure to’re each on the identical web page.

Answer: Consider your roles – spoken or unstated. Contemplate your strengths and weaknesses and play to these when managing your cash. Talk brazenly. Talk typically. We recommend conferences: temporary, weekly updates and month-to-month in-depth conferences to be sure to’re each on the identical web page. Take turns working level in your cash. Commerce off months or 60-day durations. You’ll perceive your funds higher and recognize the effort and time required to handle them.

Photograph Courtesy: Charles Deluvio/Unsplash

4. The cycle repeats itself.

We all know that individuals suppose speaking about cash simply results in combating about cash. So {couples} keep away from discussing it or they do convey up cash in the identical ineffective methods and the cycle continues.

In case your partner (otherwise you) defaults to nagging, controlling, dishonesty, or utilizing guilt to “deal” along with your issues about cash, you aren’t actually coping with something. You might be inflicting ache and driving your relationship nearer to destruction. Nobody operates optimally when she or he is injured.

Answer: Acknowledge your contribution to the cycle. Pray for knowledge and God’s energy to finish your conduct and break the cycle. Confess your sin to your partner and ask their forgiveness. Their sin is … their sin. Pray to your partner and your marriage. Keep away from the temptation to level out their flaws.

Photograph Courtesy: Thinkstock

5. God wired your partner to strategy cash the way in which they do.

After many years of analysis and work with a statistical scientist we’ve got discovered that a person’s strategy to cash is hardwired from an early age. We name this strategy to cash your Cash Character. Like whether or not you’re naturally quiet or talkative.

You will have a Major Cash Character and Secondary Cash Character that drive each determination you make about cash.

Watch any group of children with a stash of sweet and also you’ll see their Cash Personalities play out in quite a lot of methods as they deal with that “forex”. Their strategy is hardwired from a younger age.

Photograph Courtesy: Unsplash/Annie Spratt

Method to cash is hardwired from a younger age.

You could not understand this, however you assume everybody else thinks about cash the very same approach you do. And in the event that they don’t, they’re unsuitable. That goes to your partner too.

You wouldn’t ask your partner to get taller or strive tougher to vary the colour of their eyes. Secretly hoping an individual who loves to save cash at some point wakes up and has no anxiousness over a dangerous funding is comparable. This isn’t to say that all of us can’t develop and mature in our capability to acknowledge our character traits and plan accordingly. BUT somebody who likes to spend cash goes to take pleasure in that feeling ceaselessly, they usually aren’t unsuitable.

Answer: Put money into your self and your marriage and establish your Major and Secondary Cash Personalities with a scientific, statistically sound evaluation. Then discuss it.

Photograph Courtesy: Pexels

Do not let cash get in your approach.

Figuring out your Cash Personalities is so essential to a harmonious marriage that we created a free, on-line, confidential Cash Character Evaluation to assist each individual and each couple on this planet uncover theirs without cost. Understanding your Major and Secondary Cash Personalities arms you with highly effective info. Sharing them along with your partner and respecting one another helps you each create a more healthy, wealthier future collectively.

God ordained marriage to be a lightweight to the world. To indicate others a tangible instance of His love for us. God designed it and laid it out in Genesis after which Jesus underlined it throughout his earthly ministry simply to verify we didn’t miss the purpose. A united entrance is priceless.

Divorce-proofing your marriage is essential for you, your loved ones, and a watching world. Don’t let cash get in your approach.

Photograph Courtesy: Unsplash

Initially printed Tuesday, 06 August 2024.